For some of us, retirement feels like something in the distant future. However, planning and saving for retirement is a crucial step that can significantly impact your financial security and quality of life later. Most of us understand the importance of managing our pensions, but that’s not all. This guide aims to provide clear and actionable advice on what you can do to effectively save for retirement

Understanding the Irish Pension System

Ireland’s pension system is composed of three pillars:

- State Pension (Contributory and Non-Contributory): The State Pension (Contributory) is based on your Pay Related Social Insurance (PRSI) contributions, while the State Pension (Non-Contributory) is means-tested. As of 2024, the full-rate Contributory State Pension is €277.30 per week.

- Occupational Pensions: These are workplace pensions provided by employers. They come in two main types: Defined Benefit (DB) schemes, which promise a specific retirement income, and Defined Contribution (DC) schemes, where the retirement income depends on the amount contributed and the investment performance of those contributions.

- Private Pensions: These are personal retirement savings plans that you set up independently. Personal Retirement Savings Accounts (PRSAs) and Retirement Annuity Contracts (RACs) are the most common forms of private pensions in Ireland.

Starting Early: The Power of Compound Interest

One of the most effective strategies for building a substantial retirement fund is to start saving early. The principle of compound interest means that the earlier you start, the more your money can grow over time. Even small, regular contributions can accumulate significantly over decades. For instance, if you start saving €100 per month at the age of 25, with an average annual return of 5%, you could have nearly €155,000 by the time you turn 65.

Maximising Tax Relief

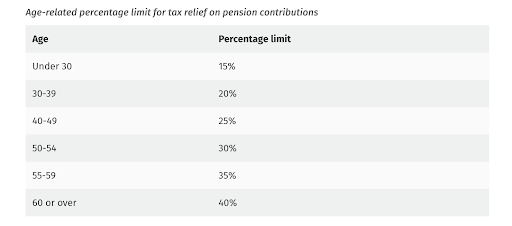

The Irish government encourages retirement saving through generous tax reliefs on pension contributions. The amount of tax relief you can claim depends on your age and income:

Source: Revenue- Tax Relief Limits on Pension Contributions

Diversifying Your Investments

When saving for retirement, it’s important to diversify your investments to manage risk and maximise returns. Consider a mix of assets such as equities, bonds, property, and cash. Each asset class carries different levels of risk and return, and the right balance can depend on your age, risk tolerance, and retirement goals. Professional financial advice can help tailor an investment strategy that suits your circumstances.

Regularly Reviewing Your Pension Plan

Life circumstances and financial goals can change, so it’s crucial to review your pension plan regularly. Ensure that your contributions are on track to meet your retirement objectives. Reassess your investment choices and adjust them to align with your changing risk tolerance and time horizon.

Planning for Healthcare and Long-Term Care

Healthcare costs can be a significant burden in retirement. In Ireland, while you may be eligible for the medical card or the GP visit card based on your income and circumstances, it’s wise to plan for potential out-of-pocket healthcare expenses and long-term care. Consider options like health insurance and long-term care insurance to protect your retirement savings.

The Role of Additional Savings

While pensions are a primary source of retirement income, additional savings can provide a valuable cushion. Building an emergency fund and investing in savings accounts, property, or other assets can offer extra financial security and flexibility in retirement.

Conclusion

Saving for retirement requires careful planning and disciplined saving. By understanding the Irish pension system, starting early, maximising tax reliefs, diversifying investments, and regularly reviewing your pension plan, you can build a secure financial future. Remember, the sooner you start, the more time your money has to grow, ensuring a comfortable and worry-free retirement!

For more advice on retirement planning and pensions, contact the Shankill Financial Services team today: 01 2393220 | info@shankillfs.ie